P3 CEO Frank Pörschke led a bank through the Global Financial Crisis and today applies his experience and leadership to the challenging conditions of 2022. He identifies talented professionals as the special ingredient for navigating disrupted markets and discusses why P3 is well placed to thrive this year and beyond. ‘Unprecedented times’ are not as unique as they seem, he says.

What’s your view of the business environment in 2022?

‘This year, inflation has reached levels we’ve not seen in decades and construction costs have increased by 40% in the past two years. This has been enhanced by the Ukraine war and supply chain problems, while land prices have also increased significantly. Meanwhile, interest rates have tripled in the past six months, which has a significant impact. Although interest rate levels in a historical context don’t look so high, this is a big step up. Further increases can be expected for some time, until the higher interest rates – or recession – bring inflation down. Some say inflation is good for property because contracts are mostly inflation linked, but this is only true if inflation doesn’t outpace the rental market significantly. Separately, perceived certainty has decreased significantly since January. I emphasise “perceived” because uncertainty was always there – the difference now is everyone’s aware of it.’

How does this affect logistics?

‘In a relative picture, logistics is probably the most attractive asset class in property. We see strong demand by tenants and in many markets rent levels have increased significantly. Of course, we’re not completely immune to economic shocks because if the recession is deep, there will be negative effects. But logistics is in a good position, as we have structural tailwinds such as the rise of online retail and companies wanting to strengthen their supply chains. These factors drive strong demand for logistics, while in other sectors, we see the uncertainties of a potential recession lowering demand. However, we’ve had to review many assumptions, as the fact base has changed frequently during 2022. Two years ago, underwriting assumptions could be the same for six months. Now, they change on a monthly basis, if not weekly. For example, you see interest rates, construction prices, yields and returns expectations moving, which means we have to adapt our own expectations.

Looking ahead to Q4 2022 and into 2023, what’s your focus?

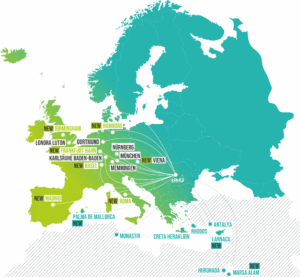

‘Right now, we see the future as more challenging, but it also contains opportunities. P3 is well-equipped, well-capitalized and well-positioned in this regard. Supported by our shareholder GIC – the sovereign wealth fund of Singapore – we have the equity to pursue investment opportunities when they come. These may be developments, individual yielding assets, forward fundings, whole portfolios or even platforms. We don’t have to put the financing together on a case-by-case basis like some players, who don’t know if they have their equity partner and debt together until the late stages. We are carefully managing our existing portfolio which has grown to more than €8bn and are searching for attractive growth opportunities. Recently, we are getting more interesting offers than before. We’ve seen on the investment market quite a few incidences of portfolios going on sale, but not achieving their target prices. With more realistic perceptions by sellers, I think P3 can react quickly to opportunities, so we’re concentrating on that at present.

Is 2022 an unprecedented challenge, from a leadership perspective?

‘I was at the centre of the storm during the Global Financial Crisis (GFC), as I became CEO of a bank when Lehman Brothers collapsed. So, I no longer have time for certainties. The challenges we see right now should not be as challenging or unprecedented as the 2008 crisis was, especially not for a player like P3. In circumstances like these, the most important factor is competence in the leadership team, combined with transparency. This means openly discussing how the environment is changing, and how you deal with it. What I encourage is for us to be open minded, use our experience, our analytical skills, and prepare for different potential scenarios. This is good practice for survival because you prepare for much more than you think is going to happen and outcomes are always different from what you expect.

For this, talent is key. We have a business which relies exclusively upon talent and capital. We are a growing company and a net recruiter, hiring for international growth and with 22 nationalities currently within the business. We recruit strong professionals with a track record to build upon our fundamentals. We also value some entrepreneurial ‘gut feel’ – which is always a great quality to have. This year, I’m very happy with how our teams are performing and we see the opportunities which come from this hard work.