Two Romanian companies have received international recognition at the third edition of the Central and Eastern European Capital Markets Awards held in Warsaw. The annual award ceremony brings to the forefront the most important achievements of listed companies in the regional capital markets.

„The international recognition of BVB efforts proves once again the size and the impact of the projects initiated in the recent years. The revival of the initial public offering market was noticed by the international community, and MedLife listing brings Romania in the spotlight of the region, showing the dynamics of the market and the returns offered to investors. We received another important signal related to the potential of the Romanian capital market in the regional financial centre”, said Lucian Anghel, BVB President.

Bucharest Stock Exchange (BVB) was awarded for „Best IR Department of a listed company in Central and Eastern Europe”.

„BVB IR team maintains direct relations with investors but is also actively involved in developing avenues and communication tools, being a leader in the field and a laboratory of new ideas. Examples of the latter are InvestingRomania, the only CEE online platform run actively by BVB in a close partnership with a national news agency, or APPLY BVB, a unique information channel available in mobile environment, or 7/24 Capital, a nucleus of a future online television”, said Daniela Serban, Investor Relations & Public Relations Director at BVB.

MedLife (M), the largest private healthcare service provider in Romania, was awarded twice at CEE Capital Market Awards for „Best overall company of the year in Central and Eastern Europe” and for „Top performing company”.

„We are extremely honoured to receive these two awards. The great performance of a Romanian business, a brand built by Romanian doctors, at the European level is important, moreover that it was achieved as a listed company at the Bucharest Stock Exchange. Without any doubt, our merger and acquisitions policy and the success of integrating new companies, along with the management of Romanian founders, added value to our work. We hope that more and more investors will come at BVB and more and more companies will understand that the road to performance goes through governance, financing by other means than private equity or commercial borrowing”, said Mihai Marcu, President of MedLife’s Board.

MedLife, founded in 1996, operates the largest private clinics’ network, several medical laboratories, general and specialized hospitals in Romania. The total value of the IPO that took place at BVB in December 2016 amounted to RON 230 million (EUR 50.5 million) for a 44% stake in the company. MedLife shares began trading at a price of nearly RON 26 and now are traded at over RON 37, an increase of over 40% in less than 9 months.

The 3rd edition of the CEE Capital Markets Awards was organized by Biznis Polska, and there were over 80 nominations in 19 categories. The other Romanian companies nominated were Bittnet, BRD Asset Management, Cemacon, Conpet, Erste Asset Management, Fondul Proprietatea, Globalworth, OMV Petrom, Patria Bank, Teraplast and Romanian law firms Bondoc&Asociatii, Clifford Chance Badea and Musat&Asociatii. The jury was made up of over 30 experts from the regional and international financial community. More information is available on the official website www.ceecapitalmarketsawards.com.

Citește și:

Cluj-Napoca scoate tirurile de tranzit din oraș. Turda mai așteaptă

Autoritatea locală a interzis traficul greu fără permis de liber acces în reședința de județ, deviindu-l însă, în…

18 iulie 2025

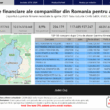

IT, energie și industrie: trinomul care duce Clujul în topul economiei naționale

Primele 20 de companii din Cluj, în funcție de cifra de afaceri pe 2024, au derulat afaceri cumulate…

18 iulie 2025

Pompierii construiesc la Moldova Nouă

Clisura Dunării face un pas important spre consolidarea siguranței comunităților locale: astăzi a fost predat oficial amplasamentul pentru…

18 iulie 2025

Bugetul mărit al UE de 2 trilioane euro, propus de Roxana Mînzatu, vicepreședinta CE

Vicepreședinta Comisiei Europene, Roxana Mînzatu, anunță adoptarea propunerii de buget 2028 – 2034 a UE. „Va urma o…

18 iulie 2025

72.000 de oameni în „Ziua Z” la Bonțida. Ploaia a dat totul peste cap

Concertul artistului principal, Justin Timberlake, a fost decalat din cauza condițiilor meteorologice. „Prima prezență în România a superstarului…

18 iulie 2025

Universitatea din Oradea plantează semințele inovației: Începe era „Living Labs”

Universitatea din Oradea face un pas important spre viitorul educației și al colaborării internaționale, lansând inițiativa „Living Labs…

18 iulie 2025

Valentin Stănescu: “IT-iștii din Cluj au o înțelegere superioară a fenomenului”

Managerul general al Dell Technologies Romania explică de ce o corporație americană cu afaceri anuale de 95 miliarde…

17 iulie 2025

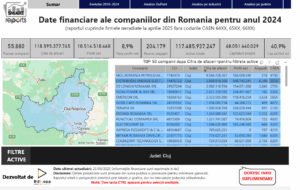

Campionii economiei din Timiș: afaceri de miliarde, profituri uriașe, pierderi-surpriză

Primele 20 de companii din județul Timiș au derulat în 2024 afaceri în sumă de peste 38,62 miliarde…

17 iulie 2025

Investiții

Pompierii construiesc la Moldova Nouă

Clisura Dunării face un pas important spre consolidarea siguranței comunităților locale: astăzi a fost predat oficial amplasamentul pentru…

18 iulie 2025

Universitatea din Oradea plantează semințele inovației: Începe era „Living Labs”

Universitatea din Oradea face un pas important spre viitorul educației și al colaborării internaționale, lansând inițiativa „Living Labs…

18 iulie 2025

Campionii economiei din Timiș: afaceri de miliarde, profituri uriașe, pierderi-surpriză

Primele 20 de companii din județul Timiș au derulat în 2024 afaceri în sumă de peste 38,62 miliarde…

17 iulie 2025

Vizită de lucru în Csongrád: Aradul vrea să preia bunele practici din Ungaria

O delegație a Consiliului Județean Arad a efectuat o vizită oficială în județul Csongrád, Ungaria, pentru a analiza…

17 iulie 2025

Investiție de peste 21 milioane lei în modernizarea Parcului I.C. Brătianu din Oradea

Primăria Oradea demarează un nou proiect de infrastructură verde urbană, cu un buget de peste 21,7 milioane lei…

17 iulie 2025

Reconstrucție verde la Nădlac: cel mai ambițios proiect urban din istoria locală

Orașul Nădlac demarează cel mai amplu proiect european din istoria orașului: investiție de 24 milioane lei pentru regenerare…

16 iulie 2025

Oradea își redescoperă inima verde – începe transformarea Parcului 1 Decembrie

Începând cu, 15 iulie 2025, Primăria Oradea a emis ordinul de începere a lucrărilor de modernizare a Parcului…

16 iulie 2025

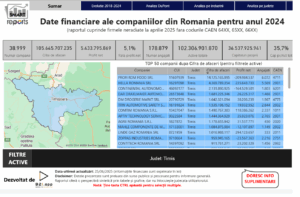

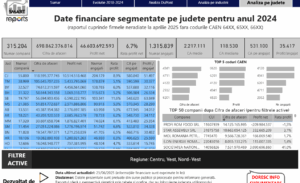

Care sunt județele cele mai dezvoltate din regiunile Vest, Nord Vest și Centru

O analiză care are la bază informații oferite de platforma SMARTreports powered by BRIDGE-to-INFORMATION, evidențiază faptul că cifra…

15 iulie 2025

Infrastructură

Clujul își primenește drumul spre Padiș. Doar până la Ic Ponor

Lucrările de îmbunătățire a infrastructurii rutiere sunt executate în principal pentru asigurarea accesului în zona turistică. Consiliul Județean…

17 iulie 2025

Vizită de lucru în Csongrád: Aradul vrea să preia bunele practici din Ungaria

O delegație a Consiliului Județean Arad a efectuat o vizită oficială în județul Csongrád, Ungaria, pentru a analiza…

17 iulie 2025

De ce pierd autostrăzile Ardealului finanțările europene

Nerespectarea de către autoritățile române a legislației UE și lentoarea derulării proiectelor lasă Autostrăzile Transilvania (A3) și Unirii…

16 iulie 2025

Jakub Kotala, noul CEO al Saint-Gobain România

Saint-Gobain România deschide un nou capitol în drumul său spre succes prin numirea lui Jakub Kotala în funcția…

16 iulie 2025

Martin Eriksson, fondatorul Mind the Product, ajunge la Timișoara

Martin Eriksson, fondator Mind the Product, vine la Prow 2025 – Conferința pentru Produsele digitale, Tehnologie și Inovație…

16 iulie 2025

Care sunt județele cele mai dezvoltate din regiunile Vest, Nord Vest și Centru

O analiză care are la bază informații oferite de platforma SMARTreports powered by BRIDGE-to-INFORMATION, evidențiază faptul că cifra…

15 iulie 2025

Autostrada dintre județele Cluj și Sălaj, exclusă din PNRR

Porțiunea dintre Nădășelu și Poarta Sălajului din A3 rămâne cu finanțare incertă, fiind eliminată de pe lista proiectelor…

15 iulie 2025

Revoluție pe șine în Oradea: încă un tramvai nou produs de Astra Vagoane Călători SA

Al doilea tramvai nou a ajuns la Oradea: parte dintr-un lot de 9 vehicule moderne pentru transportul public.…

14 iulie 2025

Turism

Clujul își primenește drumul spre Padiș. Doar până la Ic Ponor

Lucrările de îmbunătățire a infrastructurii rutiere sunt executate în principal pentru asigurarea accesului în zona turistică. Consiliul Județean…

17 iulie 2025

Vizită de lucru în Csongrád: Aradul vrea să preia bunele practici din Ungaria

O delegație a Consiliului Județean Arad a efectuat o vizită oficială în județul Csongrád, Ungaria, pentru a analiza…

17 iulie 2025

Târgul Meșterilor Populari din România, ediția XXXII, revine în weekend la Oradea

Între 18–20 iulie 2025, Muzeul Ţării Crişurilor Oradea – Complex Muzeal organizează în parteneriat cu Consiliul Judeţean Bihor,…

15 iulie 2025

Băile Cojocna, „resuscitate” în stațiune balneară

Baza de tratament subdimensionată necesită intervenții consistente, restaurantul este utilizat doar parțial, iar clădirea hotelului a funcționat foarte…

11 iulie 2025

7 lucruri care nu trebuie să lipsească din bagajul pentru plajă

Sosirea sezonului cald marchează momentul perfect pentru planuri la mare, zile relaxante sub soare și ieșiri pe nisip.…

11 iulie 2025

Atmosferă istorică la Timișoara: Festivalul Medieval al Castelului Huniade te poartă înapoi în timp, printre cavaleri și domnițe

Festivalul Medieval al Castelului Huniade are loc între 11–13 iulie și aduce în prim plan cavaleri, ateliere, muzică…

11 iulie 2025

Când va fi gata construcția celui mai mare aquapark din Nord – Vestul României

Cel mai mare aquapark din Nord – Vestul țării se va construi între stațiunile Băile Felix și Băile…

11 iulie 2025

Andreea Marinescu: „Hotelul modern trebuie să fie un spațiu viu, sustenabil și relevant pentru comunitate”

“Ne dorim să fim mai mult decât o destinație de cazare. Vrem să fim o alegere conștientă, un…

10 iulie 2025

Educație

Universitatea din Oradea plantează semințele inovației: Începe era „Living Labs”

Universitatea din Oradea face un pas important spre viitorul educației și al colaborării internaționale, lansând inițiativa „Living Labs…

18 iulie 2025

Vizită de lucru în Csongrád: Aradul vrea să preia bunele practici din Ungaria

O delegație a Consiliului Județean Arad a efectuat o vizită oficială în județul Csongrád, Ungaria, pentru a analiza…

17 iulie 2025

AQUACARAȘ premiază excelența în educație

Compania AQUACARAȘ premiază excelența în educație, acordând burse de 2.500 lei unui număr de 11 elevi din județul…

15 iulie 2025

Ziua Națională a Contabilului Român 2025: De la cifre la smart accounting

Digitalizarea aduce multe beneficii, dar și multe provocări pentru profesia de contabil și expert contabil. Ziua Națională a…

14 iulie 2025

Universitatea de Medicină și Farmacie Cluj, magnet de studenți

Numărul candidaților la admiterea în instituția clujeană de învățământ superior a crescut, în 2025, cu 660 față de…

14 iulie 2025

Roboții orădeni Afrodita și Jon Bot Jovi au făcut furori la YOKOZUNA Robot Yūshō

Echipele TOR și DARK din cadrul Robotics Club Oradea al Facultății de Inginerie Managerială și Tehnologică – rezultate…

14 iulie 2025

Topul înscrierilor timpurii la UBB: 1. Psihologie, 2. Drept, 3. Economice

Numărul candidaților din prima zi a admiterii la facultățile universității din Cluj este aproape dublu față de anul…

11 iulie 2025

Universitatea Babeș-Bolyai va sprijini tinerii cercetători în DeepTech

Instituția clujeană de învățământ superior participă la un proiect finanțat prin programul Horizon Europe al Uniunii Europene (UE).…

8 iulie 2025