Bucharest, Intercontinental, February 22nd

Supported by the IFC (World Bank Group), EBRD, TMA & Innovation Brain this networking event explores opportunities in European debt investing. DEEM 2018 brings together investors, banks and advisors to exchange insights on opportunities and challenges of operating and investing in Europe’s Emerging Markets to create a snapshot of what to look out for in 2018.

Attendees include:

Moody’s – UniCredit – Deloitte – KRUK – Schottentor Capital – Ernst&Young Rihm Rechtsanwälte – Credit Value Investments – PwC – Raiffeisen Bank

Neuberger Berman – EOS – Romexterra Leasing – NNDKP – GetBack

Hoist Finance – International Investment Bank – AnaCap – LCM Partners

Topics include:

Restructuring – Turnarounds – Distressed Debt – Special Situations – M&A NPLs – Private Equity – Alternative Investments – Insolvency

Private, Corporate & Sovereign Debt – Real Estate – Debt Purchasing

Includes optional participation at TMA’s Annual Eastern European Conference, Feb 21st at the National Bank of Romania & cocktail networking evening at Hilton Garden Inn!

Preferential registration rates are available. To find out more, please get in touch with us via info@wjglobalgroup.com for more details.

Speaker Insights

„To achieve much sought after capital and operational efficiency, banks must optimise between in-house management, outsourced management and third party sale of NPLs. For this to be achievable, lenders require a robust secondary market and a fit-for-purpose credit servicing regime. Establishing the building blocks for success continues across Western Europe, but often at different speeds in different jurisdictions. Where successful, these developments are improving the flow ofthird party capital into the NPL market, driving more competitive pricing and creating a secondary market capable of supporting lenders through-the-cycle. With increased regulatory focus and IFRS 9 becoming a reality, a robust secondary market and credit servicing regime are becoming critically important. Learning from others’ successes and avoiding their failures, must be on the agenda for all those focussed on tackling their NPL issues.”

Declan Reid

Investment Director

LCM Partners

„Romania remains one of the most attractive and active NPL markets in the CEE region. The level of market activity there remains strong. Markets are becoming more mature with some sellers now focusing on divesting their non-performing as well as their performing non-core assets; however, it is still believed that distressed situations in key European markets have yet to be unlocked.”

Lukas Fecker

CEO & Founder

Innovation Brain

„Banks have to find the optimum mix between „hold” and „sold” NPL’s, otherwise destroy value for their stakeholders. Just selling NPL’s does not solve NPL’s „per se”.

I expectyear 2018 should be more favorable for the regional buyers who look also from investors’ perspective and work on turnaround of the viable assets.”

Dana Dulciu

Head of Special Exposures Management NWUs

Raiffeisen Bank International AG

„NPLs have been remaining a hot topic in Ukraine for a while but very few foreign investors were present on the local market. Nevertheless, the series of successful reforms implemented in Ukraine recently – such as the reform of the judicial system, implementation of private enforcement service – as well as a fundamental change of DGF’s approach to the sale of NPLs have changed the landscape dramatically and raised the attractiveness of the Ukrainian market for international players.”

Anton Molchanov

Head of Insolvency

Arzinger Law Firm

„Romania is an exciting destination for PE investors, with strong macroeconomic fundamentals doubled by market consolidation in several sectors and a positive outlook. We expect PE funds to increase their activity over the next 12 months, while a good number of suitable targets to be on the market. The M&A market is facing a robust increase with a growing interest for the Romanian companies and a tendency of increasing the average transaction value.”

Ioana Filipescu

Partner | Financial Advisory Services | Corporate Finance

Deloitte Romania

SPONSORSHIP

Strengthen your profile and commitment to the region by becoming associated with the right event attended by respected investment sector decision makers.

Sponsorship packages are tailored to suit your budget and complement your marketing and branding strategy.

Contact: ej@wjglobalgroup.com.

Citește și:

AQUACARAȘ premiază excelența în educație

Compania AQUACARAȘ premiază excelența în educație, acordând burse de 2.500 lei unui număr de 11 elevi din județul…

15 iulie 2025

Transilvania Investments a intrat în parteneriat cu Sports Festival

Compania brașoveană de investiții finanțează mai multe inițiative din domeniile multisport, raliu sau șah. “La Transilvania Investments, credem…

15 iulie 2025

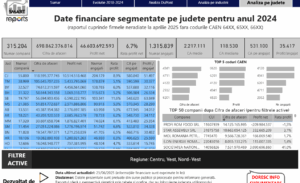

Care sunt județele cele mai dezvoltate din regiunile Vest, Nord Vest și Centru

O analiză care are la bază informații oferite de platforma SMARTreports powered by BRIDGE-to-INFORMATION, evidențiază faptul că cifra…

15 iulie 2025

Autostrada dintre județele Cluj și Sălaj, exclusă din PNRR

Porțiunea dintre Nădășelu și Poarta Sălajului din A3 rămâne cu finanțare incertă, fiind eliminată de pe lista proiectelor…

15 iulie 2025

Record de trafic pe Aeroportul Cluj. Cel mai bun semestru din istorie

Aeroportul Internațional Avram Iancu (AIAIC) şi Consiliul Judeţean Cluj au anunțat un bilanţ pozitiv al traficului aerian în…

15 iulie 2025

25 ani de IULIUS – 15 clădiri premium de birouri, 145 sedii de companii, 29.000 de angajați – un impact important în dezvoltarea segmentului office din România

Anul acesta, compania IULIUS aniversează 25 de ani de la inaugurarea primului proiect real-estate modern și marchează un…

15 iulie 2025

+ONE Brașov, incubatorul care pune startup-urile în mișcare în inima Transilvaniei

La intersectia dintre inovație, antreprenoriat și colaborare public-privată, incubatorul de afaceri +ONE, lansat la CATTIA Brașov de către…

15 iulie 2025

Târgul Meșterilor Populari din România, ediția XXXII, revine în weekend la Oradea

Între 18–20 iulie 2025, Muzeul Ţării Crişurilor Oradea – Complex Muzeal organizează în parteneriat cu Consiliul Judeţean Bihor,…

15 iulie 2025

Investiții

Care sunt județele cele mai dezvoltate din regiunile Vest, Nord Vest și Centru

O analiză care are la bază informații oferite de platforma SMARTreports powered by BRIDGE-to-INFORMATION, evidențiază faptul că cifra…

15 iulie 2025

Revoluție pe șine în Oradea: încă un tramvai nou produs de Astra Vagoane Călători SA

Al doilea tramvai nou a ajuns la Oradea: parte dintr-un lot de 9 vehicule moderne pentru transportul public.…

14 iulie 2025

Maramureșul trece la nivelul următor: investitori mari în parcurile industriale

Administratorul parcurilor de specializare inteligentă (PSI) din județ a lăsat în urmă promovarea locală sau regională: o extinde…

14 iulie 2025

Iulius Mall Cluj – experiența care fidelizează. Lider pe piața locală

Un studiu realizat de agenţia MKOR în luna mai 2025, la cererea companiei IULIUS, confirmă atractivitatea Iulius Mall…

14 iulie 2025

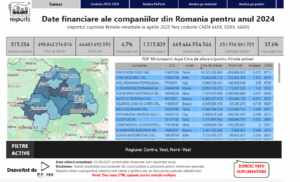

Top 25 de companii din Transilvania și Banat în funcție de cifra de afaceri

Primele 25 de companii din regiunile de dezvoltare Vest, Nord – Vest și Centru au o cifră de…

11 iulie 2025

Când va fi gata construcția celui mai mare aquapark din Nord – Vestul României

Cel mai mare aquapark din Nord – Vestul țării se va construi între stațiunile Băile Felix și Băile…

11 iulie 2025

Opt oferte pentru construirea pasajelor pietonale subterane de pe Centura Oradea

Interes crescut din partea firmelor de construcții pentru una dintre cele mai importante investiții în infrastructura pietonală a…

10 iulie 2025

Oportunități de investiții în Bihor: licitații deschise pentru PSI în cinci orașe

Agenția de Dezvoltare Locală Oradea (ADLO) a demarat procesul de licitație publică pentru concesionarea de parcele în cele…

10 iulie 2025

Infrastructură

Care sunt județele cele mai dezvoltate din regiunile Vest, Nord Vest și Centru

O analiză care are la bază informații oferite de platforma SMARTreports powered by BRIDGE-to-INFORMATION, evidențiază faptul că cifra…

15 iulie 2025

Autostrada dintre județele Cluj și Sălaj, exclusă din PNRR

Porțiunea dintre Nădășelu și Poarta Sălajului din A3 rămâne cu finanțare incertă, fiind eliminată de pe lista proiectelor…

15 iulie 2025

Revoluție pe șine în Oradea: încă un tramvai nou produs de Astra Vagoane Călători SA

Al doilea tramvai nou a ajuns la Oradea: parte dintr-un lot de 9 vehicule moderne pentru transportul public.…

14 iulie 2025

13 ani pentru primul drum expres de Cluj

Cea dintâi șosea cu acest regim din județ, DEx 4, a devenit funcțională, însă fără soluționarea optimă a…

10 iulie 2025

Opt oferte pentru construirea pasajelor pietonale subterane de pe Centura Oradea

Interes crescut din partea firmelor de construcții pentru una dintre cele mai importante investiții în infrastructura pietonală a…

10 iulie 2025

Oportunități de investiții în Bihor: licitații deschise pentru PSI în cinci orașe

Agenția de Dezvoltare Locală Oradea (ADLO) a demarat procesul de licitație publică pentru concesionarea de parcele în cele…

10 iulie 2025

ARL Cluj montează grinzile de la Pasajul Italsofa

Administrația județeană susține că nu se lucrează concomitent și la Pasajul Văcarilor din Baia Mare pentru a nu…

9 iulie 2025

Pasajul Oșorhei: Începe turnarea betonului pe cel mai aglomerat drum din Bihor

Pas important în construcția unuia dintre cele mai așteptate proiecte de infrastructură din județul Bihor. Miercuri, 9 iulie…

9 iulie 2025

Turism

Târgul Meșterilor Populari din România, ediția XXXII, revine în weekend la Oradea

Între 18–20 iulie 2025, Muzeul Ţării Crişurilor Oradea – Complex Muzeal organizează în parteneriat cu Consiliul Judeţean Bihor,…

15 iulie 2025

Băile Cojocna, „resuscitate” în stațiune balneară

Baza de tratament subdimensionată necesită intervenții consistente, restaurantul este utilizat doar parțial, iar clădirea hotelului a funcționat foarte…

11 iulie 2025

7 lucruri care nu trebuie să lipsească din bagajul pentru plajă

Sosirea sezonului cald marchează momentul perfect pentru planuri la mare, zile relaxante sub soare și ieșiri pe nisip.…

11 iulie 2025

Atmosferă istorică la Timișoara: Festivalul Medieval al Castelului Huniade te poartă înapoi în timp, printre cavaleri și domnițe

Festivalul Medieval al Castelului Huniade are loc între 11–13 iulie și aduce în prim plan cavaleri, ateliere, muzică…

11 iulie 2025

Când va fi gata construcția celui mai mare aquapark din Nord – Vestul României

Cel mai mare aquapark din Nord – Vestul țării se va construi între stațiunile Băile Felix și Băile…

11 iulie 2025

Andreea Marinescu: „Hotelul modern trebuie să fie un spațiu viu, sustenabil și relevant pentru comunitate”

“Ne dorim să fim mai mult decât o destinație de cazare. Vrem să fim o alegere conștientă, un…

10 iulie 2025

Târgul de Turism al României – Ediția de Toamnă

Cel mai mare târg de turism are loc la ROMEXPO! După succesul remarcabil al ediției din februarie, care…

8 iulie 2025

Megaproiect de 25 milioane € la Salina Turda. “Să evităm un dezastru ca la Praid”

Municipalitatea cere statului bani pentru lucrări urgente de punere în siguranță și consolidare pentru obiectivul care atrage anual…

7 iulie 2025

Educație

AQUACARAȘ premiază excelența în educație

Compania AQUACARAȘ premiază excelența în educație, acordând burse de 2.500 lei unui număr de 11 elevi din județul…

15 iulie 2025

Ziua Națională a Contabilului Român 2025: De la cifre la smart accounting

Digitalizarea aduce multe beneficii, dar și multe provocări pentru profesia de contabil și expert contabil. Ziua Națională a…

14 iulie 2025

Universitatea de Medicină și Farmacie Cluj, magnet de studenți

Numărul candidaților la admiterea în instituția clujeană de învățământ superior a crescut, în 2025, cu 660 față de…

14 iulie 2025

Roboții orădeni Afrodita și Jon Bot Jovi au făcut furori la YOKOZUNA Robot Yūshō

Echipele TOR și DARK din cadrul Robotics Club Oradea al Facultății de Inginerie Managerială și Tehnologică – rezultate…

14 iulie 2025

Topul înscrierilor timpurii la UBB: 1. Psihologie, 2. Drept, 3. Economice

Numărul candidaților din prima zi a admiterii la facultățile universității din Cluj este aproape dublu față de anul…

11 iulie 2025

Universitatea Babeș-Bolyai va sprijini tinerii cercetători în DeepTech

Instituția clujeană de învățământ superior participă la un proiect finanțat prin programul Horizon Europe al Uniunii Europene (UE).…

8 iulie 2025

Mai puțini șomeri în județul Bihor: cifrele AJOFM Bihor arată o tendință pozitivă

La sfârșitul lunii iunie 2025, rata șomajului în județul Bihor a coborât la 2,05%, potrivit datelor centralizate de…

7 iulie 2025

EU GREEN aduce inovația sustenabilă la Universitatea din Oradea

Timp de cinci zile, între 7 și 11 iulie 2025, Universitatea din Oradea este gazda întâlnirilor directe din…

7 iulie 2025