Annual results for the period 01.01.2020 – 31.12.2020

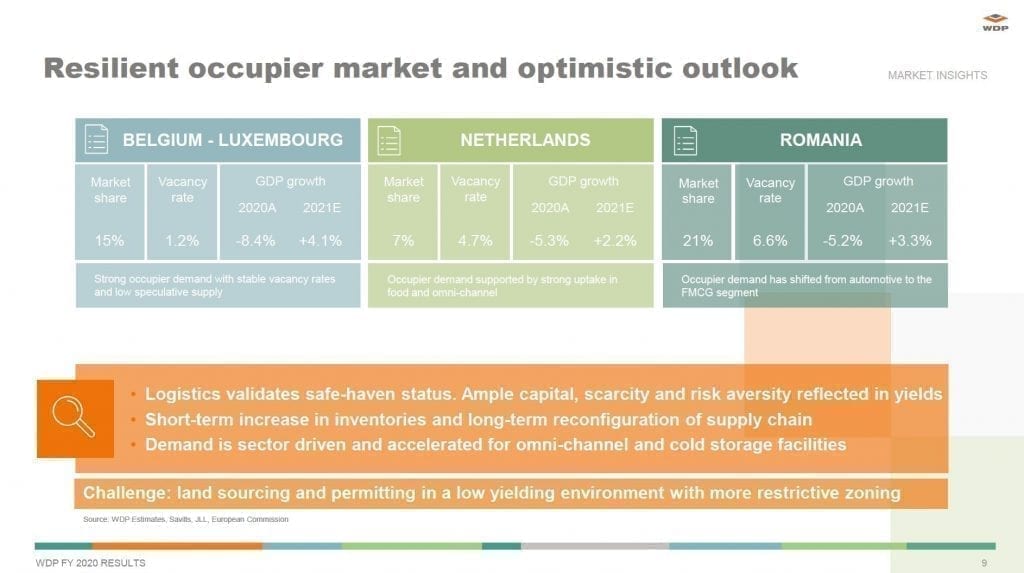

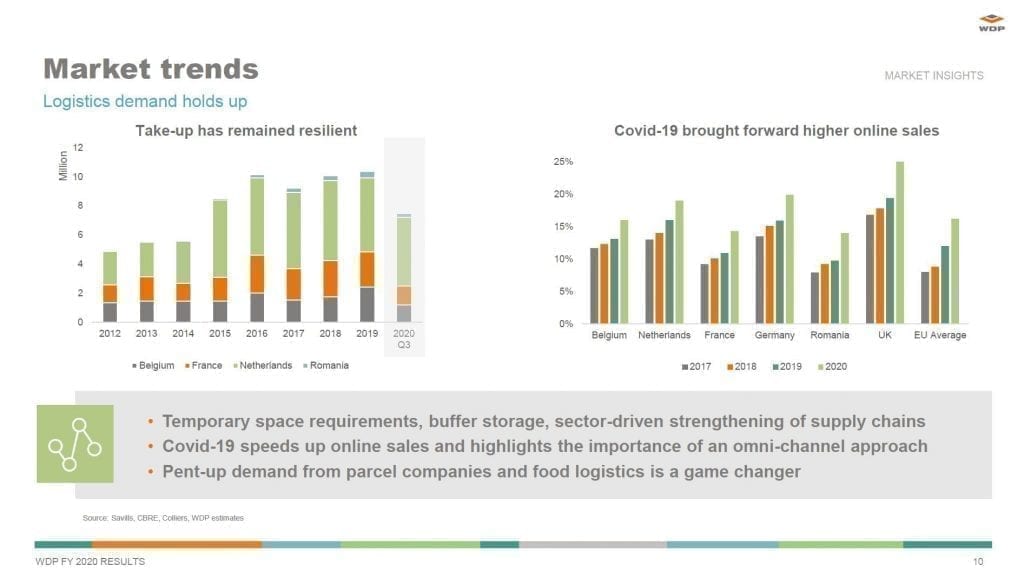

The various structural trends are accelerating. WDP currently sees continuing demand for modern logistics space, as well as post-Covid-19. Of course, vigilance regarding the crisis and its generally expected short-term negative economic impact remains necessary.

Within this context, WDP is raising its growth ambition by 500 million euros to a target growth of 2.0 billion euros by the end of 2023 (previously 1.5 billion euros).

Increased ambition related to EPRA Earnings per share to at least 1.25 euros per share in 2024 (previously at least 1.15 euros in 2023) – cumulative growth of 25% compared to 2020.

“#TeamWDP was able to achieve its targeted growth despite the challenging year of 2020. The Covid-19 outbreak has highlighted the crucial importance of the logistics sector more than ever. 2020 marked a significant step in the 2019-23 growth plan and we are upgrading our ambitions: we increase our growth ambitions byan additional 0.5 billion euros of investments by the end of 2023 and aim for EPRA Earnings per share of at least 1.25 euros by 2024. In this way, we can contribute to the further development of critical infrastructure for the post-Covid economy”, Joost Uwents -CEO, WDP.

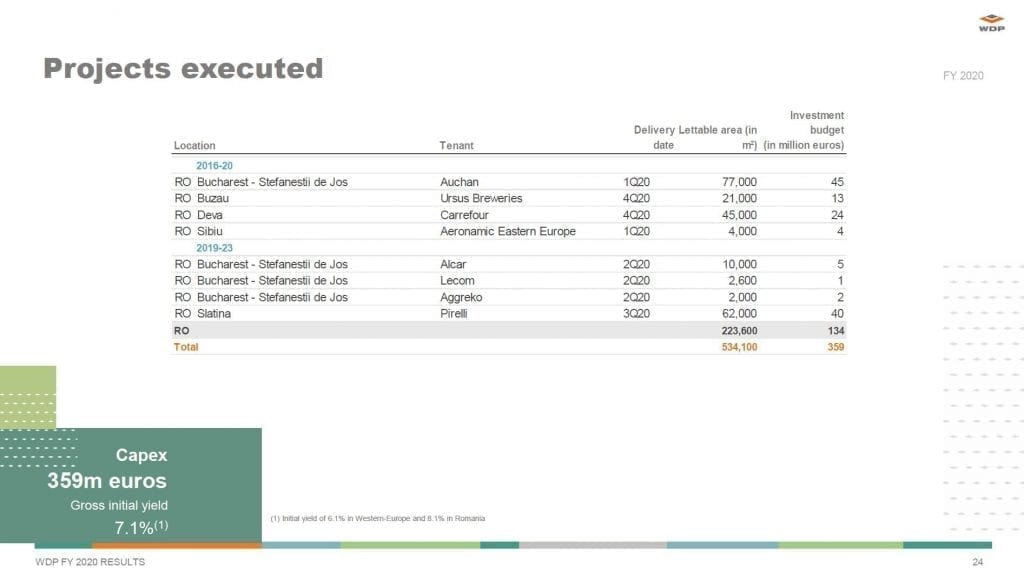

Projects completed during 2020

As announced, WDP successfully delivered the following pre-let projects with a total surface area of 534,000 m² during the course of 2020. The initial gross rental yield on the total of these completed projects is 7.1% (an initial gross rental yield of approximately 6.1% in Western Europe and 8.1% in Romania), representing an investment of approximately 359 million euros. The average lease term is 9.6 years.

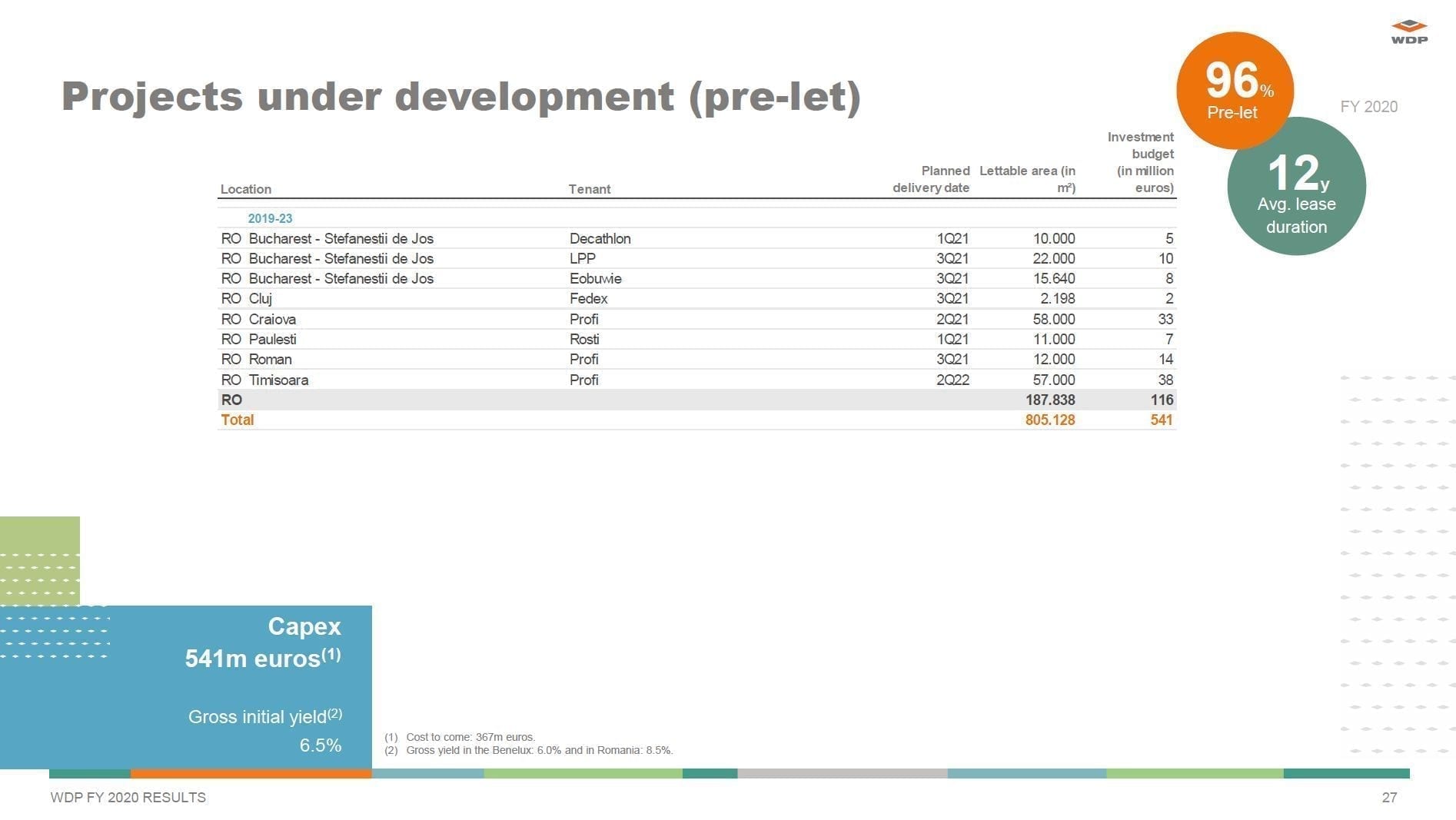

Projects under development

WDP expects that it will generate an initial gross rental yield of approximately 6.5% on the total of projects under development amounting to around 541 million euros6 and covering a total area of approximately 805,000 m² (an initial gross rental yield of approximately 6.0% in Western Europe and 8.5% in Romania). This pipeline is 96% pre-let and the average term of the lease contracts is 11.9 years.

Bucharest – Stefanestii de Jos

The WDP logistics park is being expanded to include a new distribution centre for the Polish online shoe retailer Eobuwie. Eobuwie will centralise distribution for the Romanian market from this location. After completion – expected in the third quarter of 2021 – Eobuwie will have a distribution hall of around 15,600 m² at its disposal, therefore signing a five-year lease contract. WDP foresees an investment of approximately 8 million euros.

Cluj

New construction project of circa 2,200 m² for parcel distributor Fedex, representing an investment of around 2 million euros. Fedex will lease the site for a period of ten years. Delivery is planned for the third quarter of 2021.

Covid-19 forecasts and declarations & 2019-23 growth plan

As part of the current 2019-23 growth plan, as of the end of 2020, WDP has identified a total investment package of 1 billion euros, representing two-thirds of the targeted cumulative volume of 1.5 billion euros. Therefore, the ambition of an EPRA Earnings per share of at least 1.15 euros in 2023 is within reach. Given its deep-rooted positioning within the logistics landscape, supported by robust foundations, a positive structural tailwind, as well as new opportunities arising from the Covid-19 crisis, (such as accelerated growth in e-commerce and the additional investments in omni-channel and resilience of the supply chain), WDP is already formulating the next step in its continued consistent and profitable growth. The target investment volume in the strategic 2019-23 growth plan will be increased by 500 million euros to 2.0 billion euros (previously 1.5 billion euros) by the end of 2023 – implying that the envisaged investment will have grown within the balance sheet and the annualised impact on the EPRA Earnings per share is expected in 2024. This projected growth is based on an annual portfolio growth of 10% and an annual increase in EPRA Earnings per share of 6% to a minimum of 1.25 euros in 2024 (previously at least 1.15 euros in 2023).

The dividend is expected to evolve simultaneously by 6% per annum to 1.00 euro gross per share in 2024. A number of fundamental changes and trends have accelerated the importance of the logistics sector in recent years. Examples include the continued growth in e-commerce, the demand for food and pharma-related activities, technological progress and sustainability. Distribution networks were adapted accordingly and the demand for modern logistics infrastructure was confirmed and even increased. Moreover, the Covid-19 pandemic and its sudden impact have accelerated these key drivers within the logistics sector and accentuated the critical role of the logistics sector, reinforcing WDP’s conviction and long-term vision to invest further. High demand by these sectors was shown in strong take-up in the user market, despite of Covid-19. WDP believes that, by means of its commercial platforms and positioning as a developer ánd end investor, it can continue to reap the benefits of this expected market demand, which should allow it to grow further and provide service to its clients. WDP believes that its professional local teams and in-house know-how contribute to consistent and sustainable growth. Moreover, the market share in existing markets is still relatively low (estimated at around 9% in the Benelux, limited in France and around 21% in Romania).

The investment market for logistics real estate has developed into a mature market in recent years due to growing interest in logistics real estate. This is clearly visible in the downward pressure on initial yields. In addition, strong demand and scarcity of land is shown. Most challenging in respect to growth is the acquisition of land reserve, as well as maintaining the profitability of the projects, taking into account the highly competitive environment, driven by the accelerated attraction of logistics combined with an extremely low interest rate.

More than ever, this requires a creative approach. Hence, WDP can define several trends. The limited availability of land implies a focus shift towards redevelopment locations (brownfields). The increasing costs for the development land, force real estate players to create efficient solutions that decrease the buildings’ footprint, for example multi-layer development.

Outlook 2021

WDP expects EPRA Earnings per share in 2021 of 1.07 euros, an increase of 7% compared to 2020. Based on this outlook, WDP intends to propose a gross dividend of 0.86 euros for 2021 (payable in 2022), a similar increase, based on a low pay-out rate of 80%. These forecasts are mainly driven by the strong growth of the portfolio in 2020 through pre-let new construction projects and solar projects, which will fully contribute to the group’s results in 2021. In addition, WDP currently holds a strong project development pipeline of approx. 805,000 m² and a total projected investment of 541 million euros, which will also start to contribute to the result in 2021. This outlook includes a provision of 4 million euros (0.02 euros per share) if WDP could not continue to be classified as an FBI, prompted by caution given the current important uncertainty.

In 2021, 10% of the contracts are due to expire, of which 57% could be renewed in the meantime. Based on information currently available and the existing rental market situation, WDP projects a minimum average occupancy rate of 97% for 2021. For the expected growth in 2021 based on the further implementation of the project development pipeline, a projected debt ratio of less than 50% by the end of 2021 and an average cost of debt of 2.1% that will further decrease to 1.8% are taken into account.

These forecasts are based on the current knowledge and assessment of the crisis, albeit subject to the further duration and evolution of the Covid-19 pandemic and the nature and effectiveness of the corresponding government measures and vaccination strategy, and except for a severe negative impact caused by future corona waves and/or lockdowns. Of course, some vigilance is required regarding the generally expected negative economic impact in the short term.

Financial: WDP has a robust balance sheet with healthy metrics, such as a gearing ratio of 46.6% (versus covenant at max. 65%) and an Interest Coverage Ratio of 4.9x (versus covenant at min. 1.5x). With regard to liquidity, the commercial paper programme is fully hedged and WDP also has more than 700 million euros of unused credit lines available to it, which puts it in a position to comfortably absorb the projects under development (approximately 805,000 m² that are 96% pre-let, of which 367 million euros still had to be invested as at 31 December 2020), and the maturities of debts at least until mid-2022 (circa 290 million euros). The above is also without taking into account the potential annual impact of retained earnings and the optional dividend (in 2020, 96 million euros combined).

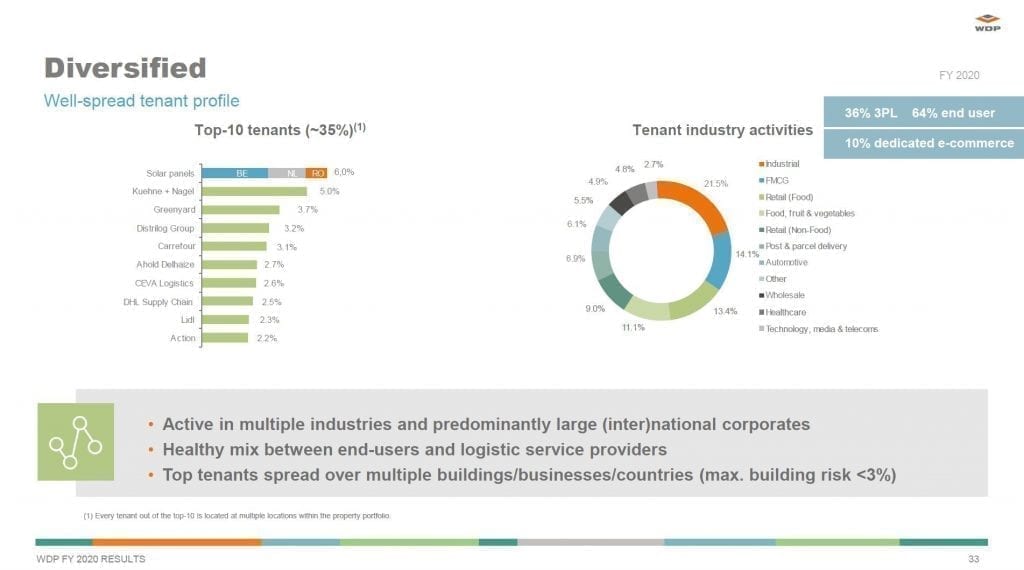

Portfolio and clients: WDP boasts a diversified and qualitative client base both in terms of exposure per country and sector as well as location, which ensures risk diversification. In addition, the warehouses are operational and functional and, in many cases, critical to the supply chain and distribution during this crisis.

Client payment behavior

Rent collection follows a regular and consistent pattern – currently WDP has received 99% of the FY 2020 rents. A limited amount of 0.9 million euros is outstanding in rent, which relates to Q2 2020, in which WDP rescheduled the payment term for a number of customers who had stated that they were experiencing liquidity problems during the lockdown. WDP expects to receive this amount, as foreseen with the clients, in 2021. As for the past due rent invoices for January 2021 (for monthly rents) and the first quarter of 2021 (for quarterly rents), WDP has already received 88%.