CTP continues to deliver strong performance, both operationally and financially, despite the macroeconomic uncertainties of the first half of this year. We believe that the growth potential of our core CEE markets remains strong and that the structural growth drivers for logistics/light industrial real estate remain intact and robust – says the CEO of CTP, Remon Vos, in a special report integrated in the GRID Magazine for this Autumn.

Full article – here.

CTP continues to deliver strong performance, both operationally and financially, despite the macroeconomic uncertainties of the first half of this year.

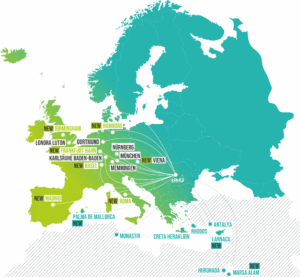

We are now active in 10 countries, building on our market leadership in our core CEE markets. Thanks to our longstanding relationships with our tenants, who continue to expand their operations with us, we’ve built an investment portfolio of serious scale and quality that continues to grow. Our current gross leasable area is now over 9.5 million sqm, with a further 1.4 million sqm under construction. Together we have a property portfolio with a value of €10.4 billion at the end of H1 2022.

Our unique-to-the-region vertically integrated full-service platform—where CTP acts as the general contractor and provides full-service development with our in-house team of experts—enables us to control costs and deliver value to our tenants and shareholders. This would not be possible without the dedication and talent of our people, who bring their passion, their hard work, their skills and their experience to the table every day for our tenants. I am very proud of our outstanding team—now over 600-strong in 10 countries—who work seamlessly together with shared values and goals, and we continue to attract talented professionals to help us grow.

Watch online video – CTP EXPO 2022 Panel 01: Nearshoring

This panel discussion, moderated by René Buck, CEO of BCI Global, explored the latest trends in modern logistics and supply chains. It focused on the phenomenon of “nearshoring” and how corporates are trying to ensure that they don’t suffer the same seismic supply chain disruptions of recent years. It looked at the impact of this trend on European economies, as well as the benefits of relocating operations to CEE and Germany.

Participants:

Remon Vos, CEO, CTP

Dirk Sosef, Head of Research & Strategy, CTP

Ondřej Novotný, Honeywell, Real Estate Director

Marc Adrion, Vitesco Technologies, Senior Corporate Real Estate Manage

Growth Remains Strong and Profitable

Despite economic uncertainties, we continued to successfully add new GLA to our portfolio by developing new properties for existing tenants in our existing parks, on land that we own, and where infrastructure and permits are in place. This has helped us deliver a market-leading 10% yield on cost of development and also de-risks the development pipeline, as we build where we know our tenants want to be. In H1 we continued to pursue the acquisition of strategic assets with yields of over 7%, including mutually beneficial purchase/lease-back deals with our tenants—for example in Romania, where earlier this year we acquired a 25,000 sqm production facility from our long-term tenant, Mobexport, and launched a new CTPark location—our 15th in the country.

In Poland, previously one of our smaller markets, we made the strategic decision to expand our footprint in H1 based on the country’s strong, long-term fundamentals and made several cherry-picked strategic land acquisitions, along with two new projects under construction. We now have 20 strategic locations in Poland, with a land bank of 2.5 million sqm and 1.2 million sqm of development potential.

I am also excited that we formally launched operations in Germany in H1, as the former Deutsche Industrie REIT portfolio is integrated into CTP’s pan-European platform. We plan to invest €1 billion over the next years in targeted developments and redevelopments in the country, mainly in urban logistics “last mile” assets.

Well Positioned to Capitalise on Opportunities

The market is changing as our clients are looking for reliable solutions and are putting structures in place to support their businesses going forward. We are already seeing the move toward near and friend-shoring supply chains, with the war in Ukraine accelerating the trend to bolster supply chain resilience. This translates into increasing demand for additional warehouse space for clients to build inventory in order to avoid supply interruptions. We are also involved in many projects to extend the activities of our clients in CEE related to production, manufacturing, and R&D.

E-commerce—an important driver of logistics growth in recent years—continues to expand in importance and will continue over the medium and longer term, regardless of any short-term softening of consumer confidence. In response to the increasing market demand among clients for renewable energy supplies, we are accelerating our solar business with the installation of additional solar panels on the rooftops of our buildings and are on track to reach our goal of over 40MWp installed by the end of the year.

CEE Fundamentals Remain Buoyant

While there is no denying that both geopolitical and macroeconomic uncertainties have increased across Europe and the world during H1 2022, we believe that the growth potential of our core CEE markets remains strong and that the structural growth drivers for logistics/light industrial real estate remain intact and robust. CEE labour costs remain significantly lower than those in western Europe, and the region rewards investors with high productivity, advanced skills and a long-established industrial tradition. These benefits, coupled with the region’s well-developed road network and strategic proximity to markets across Europe, make CEE an ideal location to near-shore supply chains. We expect this trend to continue to benefit both our industrial and logistics properties over the medium term.

Looking to the Future

Looking forward, we can be both reassured and confident. Our H1 performance gives solid momentum to our business, which is continuing in H2, and we remain excited by our growth potential over the medium term. CTP has successfully positioned itself as a leader in the most attractive segment and markets in the most dynamic part of Europe. Logistics remains an integral part of modern economic infrastructure, and demand in our core markets for highly efficient modern warehousing in strategic locations continues to grow.

Thus, while we are well aware of the uncertainties currently facing Europe and the world, we remain confident that the underlying strengths of our value-creation strategy will continue to deliver positive results based on the resiliency of our investment portfolio; the quality and diversity of our tenant base; our financial strength; our ability to develop new projects with highly favorable yields; and key structural market forces, which continue to drive demand.

As we approach our ‘10-23’ target—10 million sqm GLA by 2023—we are setting our sights even higher. With our current 20 million sqm land bank, we have the potential to grow the portfolio an additional 10 million sqm of GLA. Our new target is to reach 20 million sqm of GLA during the 2020’s—thus ‘20 2x’. To achieve this target, we are also building out our team, as you can see with our newly appointed Group CFO Patrick Zehetemayer and Dirk Socef, whom we introduce in the following pages, but also on the ground in Poland, Germany and across our core markets. CTP’s ‘Parkmaker Wheel of Growth’ helps define the value-added processes to our core business: managing our existing portfolio of clients and parks, developing new buildings in and around those parks, and newly, growing a new business—Green Energy. We are investing big into solar: more than €100 million is planned for 2023 alone. With the right people in place and with our existing assets and land bank, we feel well positioned to take CTP to the next level. We have built a highly profitable Pan-European development platform that offers both exciting organic growth and the potential to make strategic acquisitions on favorable terms. Uncertain times also bring opportunities, and we are well positioned to capture attractive targets.