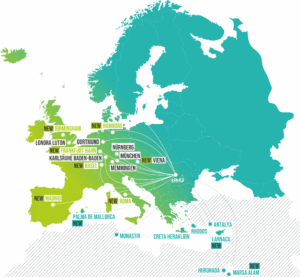

General optimism, attractive investment opportunities and more capital characterises the Central and Eastern European property market that is now considered a favourable investment destination by international investors. The second Emerging Europe Property Forum, co-organised by Portfolio Property Forum and RICS, took place on 8 November at the RICS HQ in London.

According to Thomas Mundy, Director of EMEA Capital Markets Strategy & Research at JLL, the first presenter of the conference, more and more capital is chasing fewer opportunities, which means that real estate investment activity is expected to remain strong as long as interest rates remain low.

What is remarkable in Central and Eastern Europe, is the growth of South African capital invested in the region, said Mundy. In the first 9 months of 2016 South African companies have spent $1.3 billion on CEE real estate, which has quickly made them one of the most important sources of capital in region.

Budapest and Bucharest are on the rise

One of the most important conclusions of the panel discussions at Emerging Europe Property Forum 2016 was that Budapest and Bucharest have become favourable investment destinations among international investors. Although the popularity of the Hungarian market has continuously grown over the last 12 months, it was a bit surprising that major institutional investors are now also mentioning Bucharest quite frequently as an attractive destination. During the first panel discussion, Jörn Stobbe FRICS, Managing Director of Deutsche Asset & Wealth Management, said that he would love to invest in the Romanian capital, but unfortunately a number of major transactions need to be closed by other institutional players before that can happen.

Gijs Klomp MRICS, Investment Director at New Europe Property Investments, one of the biggest South African investors present in the region, also considers Bucharest the most attractive market of CEE. Unlike most investors, he is not concerned about the lack of liquidity in Southeastern European markets as NEPI makes long term investments and is able to sit through crises.

The full story – here: http://property-forum.eu/news/bucharest-and-budapest-seem-attractive-from-london/316.

Gijs Klomp MRICS, Investment Director at New Europe Property Investments, one of the biggest South African investors present in the region, also considers Bucharest the most attractive market of CEE. Unlike most investors, he is not concerned about the lack of liquidity in Southeastern European markets as NEPI makes long term investments and is able to sit through crises.

The full story – here: http://property-forum.eu/news/bucharest-and-budapest-seem-attractive-from-london/316.

An article by – Ákos Budai