„The admission of the corporate bonds issued by our company to trading on the Bucharest Stock Exchange marks a milestone for the company, for our growth path and a promise we are making regarding our future development plans. Our main focus remains further investing, growing and sourcing new opportunities in Romania, our home country and this is another step we make towards this mission, by aiming to simplify our debt capital structure and reducing our average cost of debt,” stated Dimitris Raptis, Deputy CEO and Chief Investment Officer Globalworth.

Globalworth Real Estate Investment Limited, one of the most important real estate investment companies, focused on the CEE region, in partnership with BT Capital Partners – a company of Banca Transilvania Financial Group, announces the admission to trading on the Bucharest Stock Exchange (BVB) of the corporate bonds issued by the company (symbol GWI22). The corporate bonds issue had a total value of EUR 550 million and is the largest issue of this type in the history of BVB.

„When investors ask for bonds to be placed on the stock market, that means they appreciate a level of liquidity and transparency that contributes to investor security. So, it is very important that Globalworth corporate bonds, as a result of global placement, start trading on the Bucharest Stock Exchange. We are proud of this fact, which confirms this historical evolution of the Romanian capital market,” said Ludwik Sobolewski, CEO of Bucharest Stock Exchange.

„The bond issuance exceeds half a billion euros for the private bonds and sets a new benchmark for the capital market. This transaction is a new positive message Romania is sending out to investors stating that the local capital market has the ability and the instruments required to absorb significant transactions, both when it comes to IPOs or bonds,” Lucian Anghel, BVB’s President stated.

„The admission to trading on the Bucharest Stock Exchange of the corporate bonds issued by Globalworth should be an example for other companies and, hopefully, the Romanian business environment will start looking more towards the capital market as a source of funding. BT Capital Partners is very involved in helping to increase the level of financial intermediation in Romania and wants to become an example in this respect,” said Paul Prodan, Chairman of the Board of Directors of BT Capital Partners.

The corporate bonds GWI22 are traded on the Bucharest Stock Exchange in Euro, in denominations of EUR 100,000 and settlement will be performed in RON. The exchange rate established by the National Bank of Romania (BNR) on the banking day previous to the trading session is taken into account for the calculation of the corporate bonds value (in RON) of the executed order on that trading day. This exchange rate is applied throughout the entire trading hours of these corporate bonds, on that trading day.

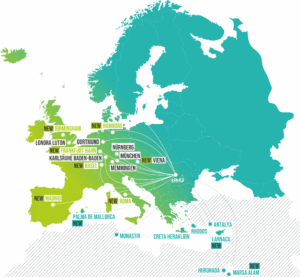

Globalworth corporate bonds have also been admitted to trading on the regulated market of the Irish Stock Exchange.

Globalworth is a real estate investment company active in the SEE and CEE regions with a prime focus on Romania. The Company is internally managed by c.70 professionals and its portfolio comprises high quality real estate investments valued at c. Euro 983.3 million at 31 March 2017, all located in Romania.

BT Capital Partners is the best retail broker in Romania and a member company of Banca Transilvania Financial Group. BT Capital Partners is the exclusive Oaklins Member Firm in Romania, the most experienced consultant for mergers and acquisitions globally. The company was the consultant and broker for more than 50 public offerings worth over 1 billion euros. BT Capital Partners was the lead manager of DIGI Communications’ IPO, the largest IPO of a private company on the Bucharest Stock Exchange. The company provides assistance with listing on a Stock Exchange and attracting investors, brokerage services, consultancy for mergers and acquisitions as well as for attracting and structuring complex financing, market research and strategic consulting.

Bucharest Stock Exchange develops the most advanced and complex array of programs among the European stock exchanges with the purpose to increase the level of financial education. BVB’s activities are dedicated mostly to existing or potential investors and to entrepreneurs, and their aim is to have a significant contribution to the development of financial literacy in Romania. The technical achievements were also part of BVB strategy and included, among other things, the development of the trading platform Arena XT, which is now used by 13 brokerage companies.

Globalworth, the largest corporate bond issue in the history of the Bucharest Stock Exchange

Globalworth announces the listing of EUR 550 million corporate bonds the largest corporate bond issue in the history of the Bucharest Stock Exchange.