VGP NV (‘VGP’ or ‘the Group’), a leading European provider of high-quality logistics and semi-industrial real estate, today published a trading update for the first quarter of 2020:

Impact of Covid-19

Our primary focus is the health, safety and well-being of our employees and partners

The VGP team is operational, mostly working from home, with full access to systems. Where allowed, our construction sites are fully operational

Until now the impact on rental payments is very limited: nearly all due payments were received on time. Some selective reprofiling discussions ongoing but it is probably too early to assess the whole impact of the respective measures taken to contain the spread of the virus on our tenants

All pre-let development projects have now been resumed with minimal timing impact of temporary suspensions; speculative developments remain frozen where possible

Focus on maintaining a strong capital position – VGP is well capitalized with significant cash headroom (including unutilized 3-year RCF of €150 million)

Operating model remains intact and business fully operational:

Total annualized rental income increased to €159.9 million (+5.0 million year-to-date)

37 projects under construction, representing 865,000 m2 or €54.4 million in additional annual rent once fully built and let (72% pre-let)

4 projects delivered during the 1st quarter, representing 54,000 m2 (100% occupancy)

Land bank replenished – 0.56 million m2 of new land bought

Signed letter of intent with Allianz in respect of new JV for development of VGP Park München

Agreement in principle to launch new 50:50 JV in H1 2020

This will be the first JV to also cover the development of a VGP park – VGP will forward sell VGP Park München to the new JV and recognize the majority of development profit at the moment of entering the JV, with sales proceeds being received at the moment of delivery of the respective buildings

Upon entering the JV, VGP is expected to receive the pro-rata share of development expenses until that date; all further future funding needs will be financed jointly

VGP’s Chief Executive Officer, Jan Van Geet, said: “Our primary focus today is the health and safety of employees and partners, yet due to the agility of our teams and operating model acting as inhouse contractor, our pre-let development pipeline is running nearly entirely on schedule.”

Jan Van Geet continued: „Whilst it was initially our intention to develop and hold the iconic VGP Park München on our own balance sheet, Allianz and VGP have found an agreement to develop this project together, acting as true partners – also in today’s exceptional market circumstances.”

Jan Van Geet concluded: “Combined with a full order book, a diversified and quality tenant portfolio across a broad range of industry segments and strong balance sheet I hope and believe we are well placed to weather the current storm.”

VGP CONCLUDES AGREEMENT IN PRINCIPLE WITH ALLIANZ TO SET UP A NEW JOINT VENTURE IN RESPECT OF VGP PARK MÜNCHEN

During the month of March 2020, VGP and Allianz reached an agreement to enter into a new 50:50 joint venture in respect of VGP Park München

Contrary to the two existing joint ventures which concentrate on the acquisition of income generating assets developed by VGP, this new joint venture will therefore initially be focused on the development of VGP Park München. The initial term of the joint venture will be for 10 years with the possibility of a 5+5 year extension

The transaction will be structured as a forward sale whereby VGP will recognize the majority of the development gain at the moment of entering the JV, with the sales proceeds being received at the moment of delivery of the respective buildings based on pre-agreed market yields

Upon entering into the joint venture, VGP will receive initial cash proceeds to cover the pro-rata share of the development expenses until that date

All future funding requirements related to the remaining construction activities will be carried jointly by the joint venture partners based on their pro-rata share

Once fully developed the park will consist of five logistic buildings, two standalone parking houses and one stand-alone office building for a total gross lettable area of approx. 270,000 m2. The entire park is pre-let to KraussMaffei Technologies and BMW (except for some residual 13,500 m2 of lettable area which is currently under negotiation with BMW). The total annual rent income will amount to approximately € 29.2 million when fully built and let

There are currently already 3 buildings and 2 parking houses under construction, with the completion of the first building for BMW, expected to occur in August 2020 and the other buildings to be delivered to KraussMaffei by November 2022. The last building of 38,000 m² could be delivered by the beginning of 2026, subject to some options held by KraussMaffei

The managerial and governance setup of the new partnership is similar to the existing two joint ventures with VGP serving the new joint venture as its sole asset, property and development manager. On behalf of Allianz group companies, the joint venture is managed by Allianz Real Estate

The transaction is subject to satisfactory due diligence and is expected to be completed during the first half of 2020

OPERATING HIGHLIGHTS 1Q 2020

Lease operations

Signed and renewed rental income of € 7.6 million driven by €5.9 million of new leases (€2.7 million on behalf of the Joint Ventures1) and €1.7 million of renewals (all on behalf of the Joint Ventures). Lease agreements in the amount of € 0.9 million were terminated

Annualized committed leases at March 2020 (including Joint Ventures at 100%) of €159.9 million (vs €155.0 million at Dec-19) of which € 104.0 million related to the Joint Ventures

Whilst it is too early to assess the impact of the current crisis on our tenant base, due to the current exceptional circumstances we are working across the Group, on a case by case basis, with some selective tenants regarding appropriate relief

Development activities

Development of 37 projects under construction totaling 865,000 m2 of future lettable area and expected to generate € 54.4 million of new rent when fully built and leased (72% pre-let)

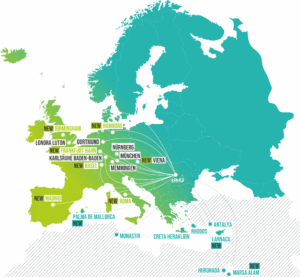

Geographical split of parks under construction: 50% is located in Germany, 13% Spain, 12% the Netherlands, 9% Czech Republic, 8% Romania, 3% Italy, 2% Hungary and 2% Slovakia

Apart from some temporary suspensions all our pre-let development projects have now been resumed with minimal impact on project timelines; speculative development projects have been frozen where possible

Delivery of 3 projects during the first quarter of in total 54,000 m2 of lettable area representing € 2.5 million of annualized committed leases; these buildings are 100% let

Land bank

0.56 million m2 of land acquired during the first quarter of 2020 (of which 0.37 million m2 in Czech Republic) bringing the total owned and secured land bank to 6.67 million m2 supporting 3.03 million m2 of future lettable area

A further 1.97 million m2 of land plots identified which are under exclusive negotiation and have a development potential of 0.99 million m2 of future lettable area

Sound liquidity and capital position

The Group has adequate cash buffers in its Joint Ventures’ portfolio’s and the Group expects that it will be able to retain its sound liquidity position for the foreseeable future through the anticipated closings with the Joint Ventures currently planned at the end of July 2020 and November 2020 supported with an unutilized 3-year revolving credit facility totaling €150 million

The Group believes that it is important to maintain a strong capital position and continually evaluates its capital markets options to finance the investment pipeline and any opportunistic investment opportunities as they arise. Whilst we are very careful and highly selective in making new investment decisions during the current exceptional market circumstances, we are conscious the current environment may also provide unique opportunities for growth which we continue to monitor closely

Proposal to pay €60.4 million dividend reconfirmed, with payment date in 2020 calendar year (exact date to be confirmed by shareholders at the AGM scheduled for 8 May 2020)

VGP is a leading European developer, manager and owner of high-quality logistics and semi- industrial real estate. VGP operates a fully integrated business model with capabilities and longstanding expertise across the value chain. The company has a development land bank (owned or committed) of 6.67 million m2 and the strategic focus is on the development of business parks. Founded in 1998 as a family-owned real estate developer in the Czech Republic, VGP with a staff of circa 220 employees today owns and operates assets in 12 European countries directly and through VGP European Logistics and VGP European Logistics 2, both joint ventures with Allianz Real Estate. As of December 2019, the Gross Asset Value of VGP, including the joint ventures at 100%, amounted to €2.77 billion and the company had a Net Asset Value (EPRA NAV) of €741 million. VGP is listed on Euronext Brussels and on the Prague Stock Exchange