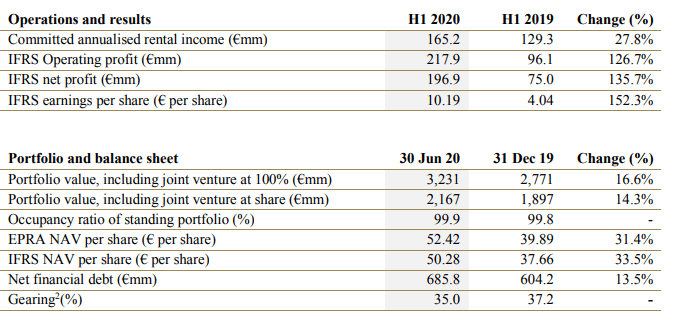

VGP, the Antwerp-based European provider of high-quality logistics and semi-industrial real estate, today announces the results for half-year ended 30 June 2020:

Operating performance resulting in a net profit of € 196.9 million

- Result positively affected by the entering into a new 50:50 joint venture with Allianz Real Estate in respect of VGP Park München

- € 20.1 million worth of signed and renewed lease agreements during H1 2020, bringing total annualised rental income to € 165.2 million (+6.6% YTD) [Compared to 31 December 2019; inclusive of Joint Ventures at 100%]

- Delivered 12 projects for a total of 190,000 m2 of lettable area in first half of 2020

- 33 projects under construction for a total of 795,000 m2 of lettable area as of 30 June 2020

- Total portfolio value increased to €3.23 billion (+16.6%YTD)1

- VGP invested in its future pipeline with 1.17 million m2 of new land bought and a further 1.97 million m2 committed subject to permits

Impact of Covid-19 remains limited so far

- All our construction activities have resumed in full

- The impact on rental payments is very limited: nearly all due payments were received on time with very limited rental payment reprofiling

- Broadened partnership with Allianz through launch of third joint venture for VGP Park München

- Balance sheet further strengthened through €200.0 million capital raising reducing gearing to 35.0% as of 30 June 2020

VGP’s Chief Executive Officer, Jan Van Geet, said: “Despite the challenging market environment due to the various Covid-19 lockdowns, we have achieved many new milestones during the first half of 2020. Demand for our buildings remained strong resulting in a broad-based and mostly pre-let construction pipeline. Furthermore, our new joint venture with Allianz in our VGP Park München has taken our cooperation to a next level and made our balance sheet stronger than ever before.”

Jan Van Geet added: “We have acquired a couple of big trophy land plots during the period, despite fierce competition on the market, thanks to the agility of our team and our reputation. I expect these land plots to be the main driver of value creation going forward as we already register a lot of appetite for these new locations.”

Jan Van Geet concluded: “We permanently focus on opportunities to continue to expand our portfolio pipeline; besides, we are working hard to become a major supplier of renewable energy for our tenants.”

FINANCIAL AND OPERATING HIGHLIGHTS

New leases signed

• Signed and renewed rental income of € 20.1 million driven by 200,000 m² of new lease agreements signed, corresponding to € 11.4 million of new annualised rental income

• During the period for a total of 164,000 m² of lease agreements were renewed corresponding to € 8.8 million of annualised rental income of which 30,000 m² (€ 1.7 million) related to the own portfolio and 134,000 m² (€ 7.1 million) related to the joint ventures. Renewed contracts within the joint ventures portfolio included various prolongations by 1-5 years.

• Terminations represented a total of € 1.2 million or 25,000 m², all within the joint ventures’portfolio

• The signed annualised committed leases represent € 165.2 million3 (equivalent to 2.84 million m² of lettable area), a 6.6% increase since December 2019.

Construction activity

• A total of 12 projects completed delivering 190,000 m² of lettable area, representing €9.9 million of annualised committed leases (as of 24th of August 2020 this has increased to 311,000 m2 of lettable area)

• Additional 33 projects under construction which will create 795,000 m² of future lettable area, representing €49.5 million of annualised leases once built and fully let – the portfolio under construction is 73.4% pre-let

Implications of Covid-19

• VGP’s business is progressing well in 2020 despite the Covid-19 pandemic. The entire VGP team has been operational throughout the crisis with full access to central systems. None of the VGP workforce has been furloughed and the Group has not taken any government support.

• The lockdown measures implemented by governments across Europe to combat the spread of the virus resulted in widespread disruption across many sectors of the economy. In some cases, this has impacted the operations and cash flows of VGP’s customers, which has in some limited cases affected the level of rent we were able to collect from such customer. VGP has worked constructively to support customers facing genuine cash flow challenges by offering to reschedule rental payments or reprofiling. None of our customers so far has requested to return their rented space.

Land bank has continued to expand

• Acquisition of 1.17 million m² of development land and a further 1.97 million m2 committed subject to permits which brings the remaining total owned and secured land bank for development to 6.89 million m², which supports 3.12 million m² of future lettable area.

• A further 0.85 million m² of new land plots identified which are under negotiation and having a development potential of 0.41 million m² of future lettable area.

Setup of new business line VGP Renewable Energy driving increase in photovoltaic investments

• In July 2020, our first photovoltaic project was delivered in Nijmegen, Netherlands (1.5MWP) and further 16 photovoltaic projects are under construction for total 17.6 MWP. This is split between Germany (10.4MWP) and the Netherlands (7.2MWP). In addition, several pipeline projects are currently being identified in Germany and Spain. As of year-end 2019 we had 16.5MWP installed on VGP’s roofs which are owned and operated by third parties.

Expansion of partnership with Allianz Real Estate through launch of third joint venture

• In June 2020, VGP and Allianz Real Estate entered into a new 50:50 joint venture for the development of VGP Park München. This is the third joint venture with Allianz Real Estate.

• The managerial and governance setup of the new partnership is similar to the first two joint ventures between the two partners with VGP serving the new joint venture as its sole asset, property and development manager. Contrary to the two existing joint ventures which concentrate on the acquisition of income-generating assets developed by VGP, this new joint venture will initially be focussed on the development of VGP Park München.

• Once fully developed the park will consist of five logistic buildings, two stand-alone parking houses and one office building for a total gross lettable area of approx. 270,000 m2. The park is almost entirely pre-let to KraussMaffei Technologies and BMW. BMW has formally taken the decision to also move its competence centre for batteries to VGP Park München. This will result in the park being 100% pre-let. This new lease contract is currently being exchanged with BMW.

• There are currently already 3 buildings and 2 parking houses under construction. The delivery of the first building to BMW occurred at the beginning of August 2020. The subsequent completions are scheduled to occur in November 2020 (1 parking house), 1 building (currently under negotiation) by mid-2021 with all but one of the remaining buildings being delivered by November 2022. The last building is expected to be delivered by the beginning of 2026.

Balance sheet further strengthened through capital raising whilst two additional joint venture closings are anticipated before the end of the year

• On 21 April 2020 VGP successfully completed an offering of new shares for a total consideration of €200.0 million by means of a private placement via an accelerated bookbuild offering to international institutional investors.

• In the offering a total of 2,000,000 new shares (approximately 10.8% of VGP’s outstanding shares on completion of the offering) were placed at an issue price of €100.00 per share, representing a discount of 4.58% compared to the last traded price of the Group’s share on 21 April 2020 of €104.8.

• In line with their pre-commitments, Little Rock SA, controlled by Mr Jan Van Geet, and VM Invest NV, controlled by Mr Bart Van Malderen, have each subscribed for 33.81% and 20.16% of the new shares respectively, and received full allocations.

• In terms of further expansion with the joint ventures we anticipate two additional closings before the end of 2020. The seventh closing with VGP European Logistics (first joint venture) is anticipated with a transaction value of >€150 million as well as the second closing with VGP European Logistics 2 (second joint venture) with a transaction value of > € 200 million

• These steps will ensure VGP can maintain its financial purchasing power and to be able to finance the investment pipeline and to benefit from additional investment opportunities.

KEY FINANCIAL METRICS