The total investment volume in Romania reached EUR 323 mln. in the first half of 2022, 6% higher compared with the amount transacted in the same period of the previous year, according to the Romania Real Estate Market Outlook 2022 research by CBRE Romania. 542,000 sq. m of industrial and logistics spaces were leased in H1 2022, a 50% increase compared with the same period of 2021, according to Cushman & Wakefield Echinox.

An article part of the cover story in TB 111 magazine – “Oradea: Business Next Level & LifeNouveau” available here.

In the first six months, 14 transactions were signed, with an average value of 23 million euros. At the same time, 79% of the year-to-date volume was concluded during the second quarter of the year. The largest transaction of the year to date was signed in the second quarter of the year, with the acquisition of EXPO Business Park by S IMMO AG from Portland Trust, assisted by CBRE. Claiming the largest share of the total investment volume, Bucharest attracted 10 transactions. Only 20% of the total investment was directed towards regional cities out of which Cluj-Napoca emerged as the most sought-after regional location. From the point of view of the market sectors, the office sector occupies the first position, with 62% share from the H1 2022 overall country investment volume. Industrial claims 15% and retail properties represents 12% from the total volume, while hotel and mixed-use properties have a joint share of 11%, according to CBRE Research. Regarding the nationality of the investors, the most important part of the capital, 37% of the total investment volume, was brought by Austrians, followed by Belgians (22%) and Romanians (18%). In the first quarter of 2022, the source of capital was exclusively foreign, Romanian investors closing several deals in Q2. With investment deals pipeline quite consistent, the year’s total investment volume could surpass the 2021 volume. The pipeline of investment deals will be defined by the leasing market, combined with the ongoing outlook for financial conditions in the broader monetary markets.

”The pipeline of activity for 2022 remains very strong and we are certainly seeing the premises for one of Romania’s strongest years in terms of transactional volume. The outlook for 2023 is more mixed, as the ongoing interest rate hikes are having a downward effect on liquidity. Even in this context, Romania’s high yields by regional standards are acting as a buffer to safeguard activity.” says Mihai Pătrulescu, Head of Investment Properties at CBRE Romania.

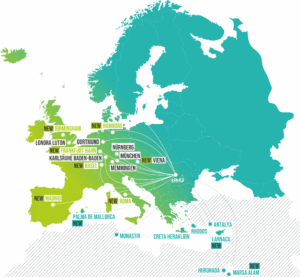

Expanding the networks

Bucharest modern office stock reached 3.30 mln. sq m at the end of first half of 2022, as four office projects with approximately 100,000 leasable sq m were delivered. The Center-West area of the city represents almost 60% of the new supply, as two projects – Sema Park II – Oslo & London building (31,500 leasable sq m) and AFI Tech Park 2 (24,500 leasable sq m) – were added to stock. At the same time, the Center and North-West sub-markets include two new deliveries, Tandem and the first phase of @Expo. Moreover, another 41,400 sq m in two office buildings will be added to modern stock by the end of the year. 83% of the total area to be delivered will be added to the Center-West area’s stock, in one building, One Cotroceni – phase 2, with a GLA of 34,500 sq m. The remaining 17% is claimed by Center sub-market which will welcome Tudor Arghezi office scheme, a 7,000 leasable sq m project. At the same time, the Capital city’s modern office stock will have another approx. 94,000 sq by the end 2023.

„On the industrial side, following a c.7% growth of the leasable modern warehousing stock, it closed in on the 6 million square meters level. Demand is still on par with record levels seen in the last couple of years, owing to the fact that the local modern stock remains well behind it should be for a market that grew as fast as Romania during the last decade”, says Laurentiu Lazar, Managing Partner for Colliers Romania.

A similar trend of a fast-growing market that remains undersupplied and which feeds into stronger demand for storage spaces is the retail sector, where the stock per capita remains well lower than in Poland or Czechia for similar levels of consumption.

“Apart from the traditional demand for larger formats, Small Business Units (SBU) and Last Mile Logistics (LML) are becoming more attractive. The truly modern stock in Romania is limited and only in recent years has shown some signs of more robust growth down the line. When looking strictly at SBUs, there are only a handful of modern schemes worth looking at and these will serve as a testing ground to see if there is potential. Last-mile projects have also started developing faster only more recently. Given the high population density that a city like Bucharest has, the overall transport infrastructure has been more strained with each passing year. In other words, the need for last-mile projects and, even more relevant, in-city logistics makes sense in the long run. Demand for these formats has seen an increase in requests over the last 3 years”, explains Victor Coșconel, Head of Leasing | Office & Industrial Agencies la Colliers.

Overall, the total I&L stock for the CEE-15 region has grown to exceed 50 million square meters, with 20 million square meters situated in and around the 15 capital cities markets. Poland maintains the largest I&L market and is approaching the 25 million square meters mark. The recent „ExCEEding Borders I&L” report released by Colliers indicates that all CEE-15 countries have seen an increase in enquiries for SBU/LML space. This is connected, among others, with the significant development of the e-commerce sector and courier services. These factors mean that in the coming quarters we can expect further significant development of this market segment in CEE-15. The total stock of typical SBU / Last Mile Logistics space in the CEE-15 countries accounts for over 3 million square meters and another 500,000 square meters of SBU/LML space under construction.

542,000 sq. m of industrial and logistics spaces were leased in H1 2022, a 50% increase compared with the same period of 2021, according to data from the Cushman & Wakefield Echinox. The volume transacted in Q2 was of approximately 240,000 sq. m, which was added to the Q1 take-up of more than 300,000 sq. m. A net take-up of 86% was recorded in H1, while the remaining 14% consisted of contract renewals and renegotiations. Bucharest attracted over 54% of the transactional volume, while an important leasing activity was also noticed in Ploieşti (16%), Timișoara (6%) and Cluj (3%). Demand was driven by various sectors, as retail and ecommerce (28%), along with logistics and distribution (11% market share) and automotive (5%) companies were the most active in Q2 2022.

The stock of modern industrial and logistics spaces in Romania exceeded 5.9 million sq. m and it will break the 6 million sq. m threshold by the end of the year given the developers’ current plans. Around 3 million sq. m of such spaces can be found in projects located around Bucharest, while Timișoara (583,000 sq. m), Cluj-Napoca (412,000 sq. m) and Ploiesti (370,000 sq. m) represent the main regional logistics hubs. New projects totaling almost 600,000 sq. m are currenly under construction in Romania, as Bucharest remains the most active market, with a pipeline of over 300,000 sq. m, developers also being active in Oradea, Cluj or Timișoara.

Andrei Brînzea, Partner, Land & Industrial Agency, Cushman & Wakefield Echinox: “The industrial and logistics market continues to have a balanced evolution in terms of supply and demand, as we witnessed a national vacancy rate decrease below 4%, the lowest level recorded during the last five quarters. The second half of the year is marked by inflationary pressures and also by the increase in construction costs, but the market should still be able to reach at least the 2021 levels in terms of demand”.

The low availability of inner-city land plots will further increase the prices

2021 has marked a further increase in land prices on a national level and especially in the capital city. Bucharest has a higher GDP per capita than the EU average, which supports a constant demand for office, residential or logistics developments, according to Crosspoint Real Estate Romania. This consistent growth, together with the decreasing availability of inner-city plots suitable for medium to large scale developments, have created a very dynamic land market.

The number of land transactions in Bucharest and Ilfov was 12% lower than the previous year, yet the largest deals alone amounted to over 350M €. Residential developments were the main destination for the land plots acquired in Bucharest in 2021, with an overwhelming 68% share in total activity. Due to the increasing scarcity of inner-city plots, the development of surrounding locations in Ilfov county has continued in 2021. The metropolitan areas of the main cities suitable for residential developments are more and more in demand.