12 new buildings are expected to be added at the modern office stock with a total gross leasable area of approximately 214,000 sq m in 2020, according to “Romania Real Estate Market 2020-2030” report launched by CBRE, in a dedicated event, on February 5th.

At the end of 2019, 41% of all projects under construction were already pre-leased. 44% of the new supply is expected to be delivered in North sub -market, hosting large scale projects such as Globalworth Square with a GLA of 30,000 sq m developed by Globalworth, Ana Tower developed by Ana Holding with a GLA of 33,000 sq m and One Tower by One United comprising a 24,000 sq m GLA.

Targeted by tenants as well as by developers West sub-market will accommodate 27% from the total area to be delivered, comprising schemes like The Bridge phase 3 with a GLA of 20,200 sq m developed by Forte Partners and Campus 6 phases 2 & 3 with a total GLA of 37,400 sq m developed by Skanska. With a share of 15% from the total area to be delivered in 2020, Pipera sub-market welcomed already the Globalworth’s project with a gross leasable area of 32,000 sq m, Globalworth Campus-Building C.

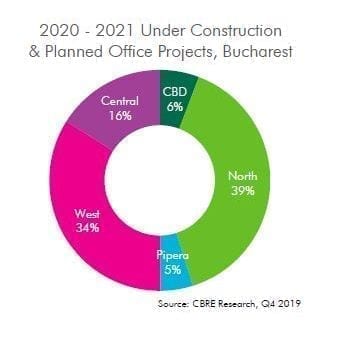

For the next 2 years, approx. 673,000 sq m are expected to be added, raising the Bucharest modern office stock at approx. 3.9 mln sq m. From the total forecasted area, 55% is under construction while the remaining is under different phases of planning. North sub-market closely followed by West sub-market jointly claim 73% from the total modern office space to be delivered in the 2020-2021.

Romania’s investment volume broke the one-billion-euro barrier and totaled at the end of 2019 EUR 1.06 bln., finally surpassing the previous peak volume reached 5 years ago. The year-end total investment volume is with 7% higher than the figures registered in 2018 reflecting an upward trend since 2015. The average deal value for the entire year stands at EUR 29 mln. similar to previous year’s average value.

Prime rents will face an upward trend as the pressure for class A, premium space is strongly experienced, and the most sought-after sub-markets North and CBD are already close to saturation. Demand will follow on the same steady path with newcomers on the office market as Romania is known already worldwide for its top talents with IT skills and excellent foreign language speakers.

The modern office stock reached 3.2 mln. sq m at the end of 2019, as approx. 293,000 sq m were added to the stock throughout the year. From the total new supply, half was delivered in West sub market, 23% in the North sub market, 10% in the Central, while CBD and Pipera sub markets jointly accounted for 17% from the total deliveries.

2019 was a prolific year for the office market, as from the first part of the year the modern office stock surpassed the 3 mln. sq m threshold and changed its composition with mainly class A office buildings, respectively 53% from the total. Moreover, the new supply delivered during 2019 reached similar levels with the 2016 new supply, record levels from 2009 to present.

“I would refer more to transformational developers. I think the moment that Skanska entered in the market was a defining moment for what happened in the last period for Romania and the way the other developers also started to act and to be focused on all the values that Skanska is crazy about. We’ve seen a very good example with Vastint at Timpuri Noi, in fact everybody did something; when AFI entered the West, there was nobody there and everybody is going to the West. I am looking forward to see how One United will perform in Cotroceni, because the project is looking amazing. What would be very interesting is to see more transactions and this is what we are talking about, to go above the 1 bln., but this is not happening because you have Immofinanz, CA IMMO, companies who are doing very well here, so why should they sell? If the market is so stable, if their buildings are good there is no reason to sell, they are making so much money here. On the other hand you have high margins for developers and this is one of the reasons for which Globalworth started to buy in Poland and they were developing here, so it’s an interesting market”, stated Razvan Iorgu, Managing Director, CBRE Romania, asked to summarize transformational projects or developers for the coming years for the Romanian market.

- The modern office stock reached 3.2 mln. sq m at the end of 2019, as approx. 293,000 sq m were added to the stock throughout the year.

- Romania’s modern retail stock reached 3.75 mln sq m at the end of 2019, 32% of the total amount is located in Bucharest while the remaining is placed throughout the country.

- Romania modern industrial stock at the end of 2019 gathers 4.3 mln. sq m as the yearly new supply totaled 477,000 sq m.

Photos: Mircea Dragos